What is prioritisation?

Prioritisation is choosing what’s most important and doing that first. It is the ability for you to make decisions on thing that matter now, and act on it. Presently, almost all activities you engage in require money from emergency funds, Tuition fees, investment opportunities, even that trip you swore you’d take, and a rising cost of living that’s presently choking you by the neck.

It's easy to feel like every financial goal is urgent after listing them out, such as wanting to go to Zanzibar, buy a Benz for my mom, or spend money at the club. However, trying to chase all these goals at once can lead to burnout, debt, or, even worse, stagnation. Instead, it's important to prioritise.

Prioritization is not about choosing between good and bad options; it’s about sequencing and evaluating your goals based on matters of urgency.

Here are 5 steps On How to Prioritise Your Financial Goals

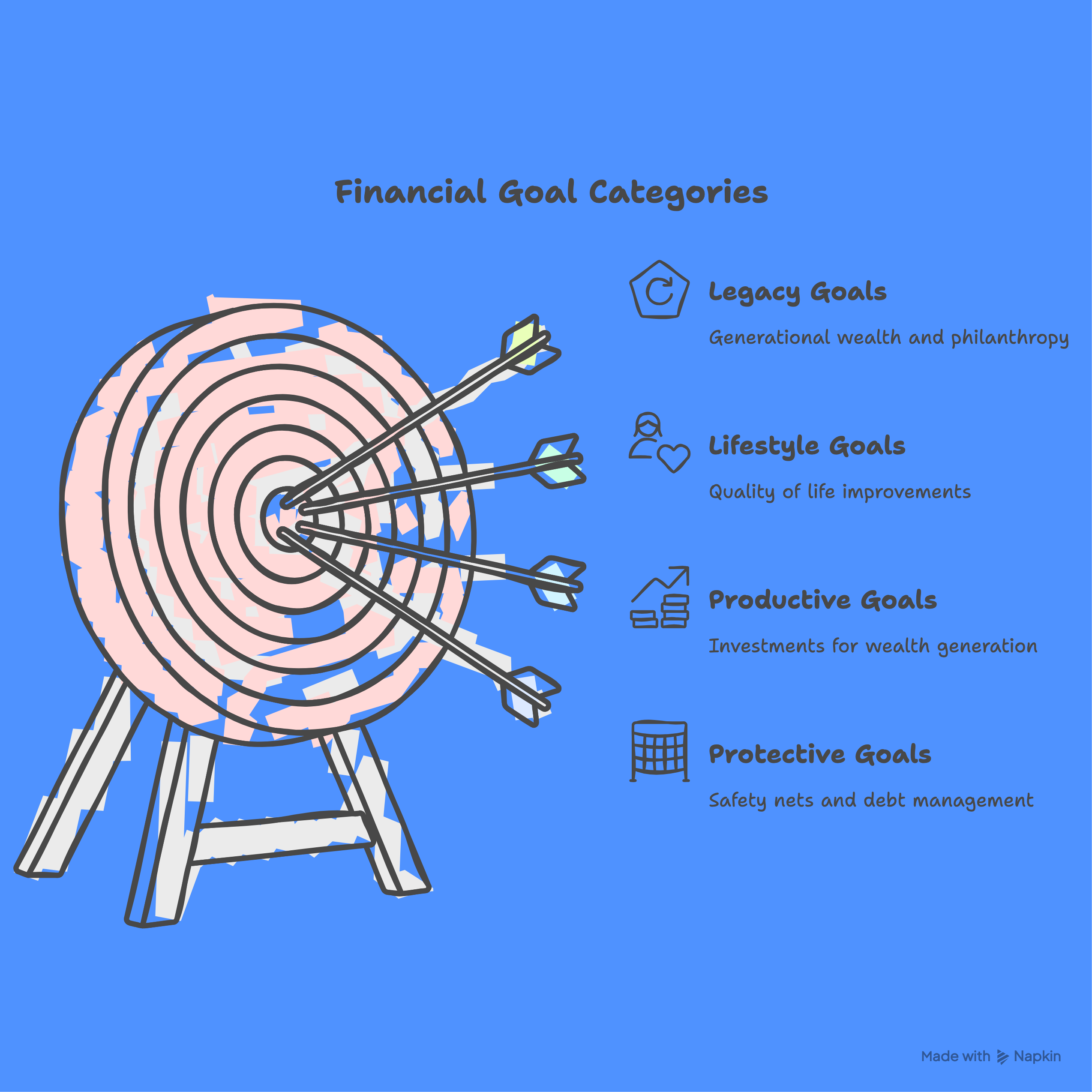

Step 1: Identify Your ‘Core 4’ Financial Goal Types

Every financial goal falls into one of four categories. Knowing which type you’re dealing with helps you assign urgency and purpose:

- Protective Goals: These are like safety nets as they include things like emergency savings, insurance, and debt repayment

- Productive Goals: these are investments that generate long-term wealth (e.g., index funds, real estate, upskilling)

- Lifestyle Goals: these are non-essentials that improve quality of life (travel, home upgrades, wellness)

- Legacy Goals: Generational wealth, philanthropy, and impact-driven finance

Pro tip: Use a 40/30/20/10 mental model - Allocate 40% of your attention on protective, 30% on productive, 20% on lifestyle, and 10% on legacy, until your protective layer is rock-solid, then you can rebalance.

Step 2: Assign Timeframes, Not Just Money Amounts

A goal without a timeline is just a wish. And here is how you mess it up, you only assign money targets, whereas it would be better if you asked yourself this question, by when do I want to achieve this target?

So as we are all about helping you achieve optimal decisions in your finances. Group your goals into three time frames:

- Short-Term (0–12 months): High urgency (e.g., 2 Million naira emergency fund, paying off high-interest debt)

- Mid-Term (1–3 years): Growth and mobility (e.g., saving for a car, switching careers, moving cities)

- Long-Term (3–10+ years): Wealth and freedom (e.g., home ownership, retirement, funding your startup)

With this, you know you don’t have to hit everything now; you just need to know what belongs when and keep track of your actions to achieve the results.

Step 3: Create a Cashflow-Backed Priority Stack

It’s one thing to want to prioritise investing. It’s another thing to have the cash flow to do it. The magic happens when you align your priorities with how money flows in and out of your life.

Build your “Priority Stack” by doing this:

- Write out your top 5–7 financial goals

- Estimate how much monthly cash flow each one realistically needs. Let's say you earn ₦500,000 a month in Lagos. You have three goals - save ₦1.2 million for rent in the next 12 months, buy a used car worth ₦3 million in 18 months, and take a trip to Ghana that’ll cost about ₦600,000 in 6 months. To reach each goal on time, you’ll need to save ₦100,000 monthly for rent, ₦166,667 for the car, and ₦100,000 for the trip, adding up to ₦366,667 each month. But if your monthly expenses (like food, electricity, transport, etc.) come to ₦250,000, you’re already over budget. You only have ₦250,000 left after essentials, so it’s not realistic to fund all three goals at the same time unless your income increases or your expenses decrease. So this is where prioritisation comes in. You might decide to delay the Ghana trip, stretch the car goal to 24 months instead of 18, or look for ways to increase your earnings.

- Sort them by impact vs effort using a 2x2 matrix

With this method, every month, make sure to review the stack and reallocate cash as your income grows or expenses shift.

Step 4: Kill the “Goal Guilt” with Season-Based Focus

You don’t need to hit every goal this quarter. Sometimes, you’re in a savings season, other times an investment season, or even a learning season.

By committing to one dominant focus per 90 days, you’ll make real progress and kill the mental fatigue of juggling everything.

Step 5: Automate the Boring, Track the Exciting

Not every financial goal needs your constant attention. Automate contributions to things like retirement, emergency savings, and debt payoff. Then track and celebrate progress toward the goals that excite you, like investing in your business or funding a dream trip.

Every method outlined in the article can be achieved with the use of Balancc, a financial clarity app that helps you make the right decision in your finances.

And for reading to this point, I’ve got a gem for you. If everything still feels important, ask yourself these questions:

- Which goal protects me today?

- Which goal unlocks growth tomorrow?

- Which one moves me closer to who I want to become?

- What’s the cost of delaying this goal by 6 months?

The last question often reveals what truly matters now and what can be adjusted forward.

In finance, you don’t need to do everything, you just need to do the right next thing. And with the right system, prioritising becomes less about choosing and more about sequencing.